1. Profit and Loss

Mathematicians use the profit and loss formula to calculate market prices for goods and to assess how successful a company is. There is a selling price and a cost price for every goods. We can determine the profit made or loss suffered for a certain product based on the values of these prices. Cost price, selling price, profit, loss, etc. are some of the key words that are addressed in this article. Here, we will also study the formula for the profit and loss %.

1.1 Concepts

1.1.1 Cost Price (CP)

The price at which an article is purchased is known as its cost price. For example, if Jim bought a hat for £5, it’s cost price i.e., CP = £5.

1.1.2 Selling Price (SP)

The price at which an article is sold is known as its selling price. For example, if Jim sold the hat for £8, it’s selling price i.e., SP = £8.

1.1.3 Profit

When SP > CP, we earn a profit. For example, Jim earned a profit of = £8 – £5 = £3.

| Profit = Selling Price (SP) – Cost Price (CP) |

1.1.4 Loss

When SP < CP, we incur a loss. For example, if an umbrella is bought at £12 and later sold for £9, the seller incurred a loss of = £12 – £9 = £3.

| Loss = Cost Price (CP) – Selling Price (SP) |

1.1.5 Profit Percent (P%)

It is the percentage of profit on the cost price.

| Profit% = Profit⁄CP × 100 |

1.1.6 Loss Percent (L%)

It is the percentage of loss on the cost price.

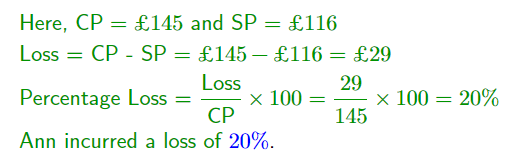

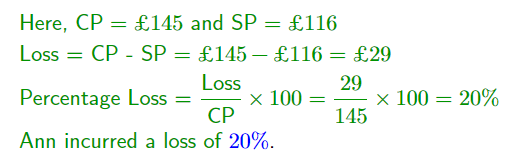

Example: Ann bought a table for £145. She then sold it for £116. Calculate her percentage loss to the nearest whole number.

Solution:

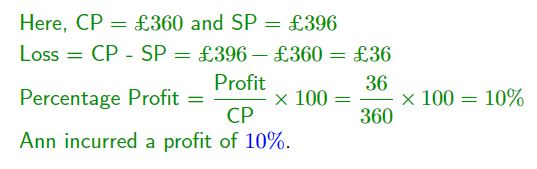

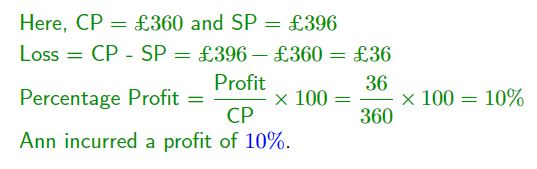

Example: John bought a scientific calculator for £360. He sold it for £396. Calculate John's percentage profit.

Solution:

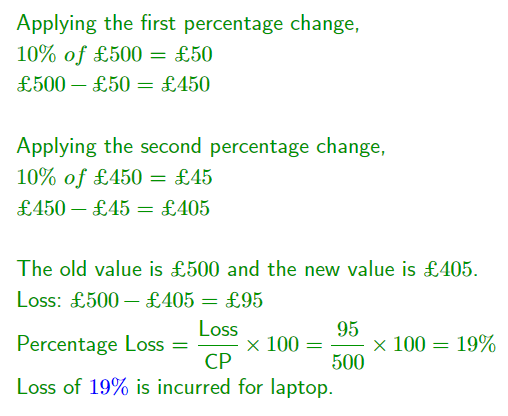

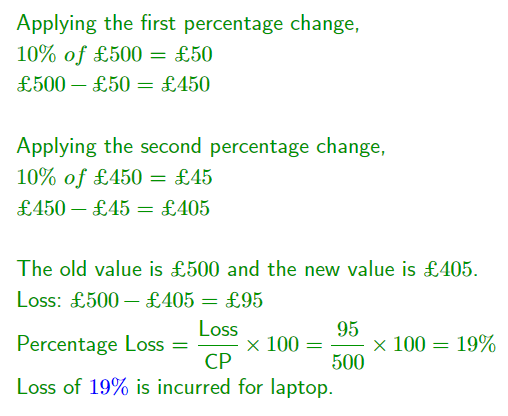

Example: A laptop costing £500 was reduced by 10% in a sale. 2 weeks later the sale price was reduced by 10%. Find the overall percentage loss in price.

Solution: